In this post, I am going to explain about PayManager, its features and how to use it. So, have a quick look at Pay Manager, how to login in Paymanager, how to prepare the salary and much more.

What is PayManager?

PayManager is a pay bill preparation system, an initiative taken by the Government of Rajasthan, for its State Government Employees. The Pay Manager portal is managed and monitored by the Finance Department of Rajasthan Government.

PayManager website is developed by the National Informatics Centre which provides a common & Integrated platform to prepare the pay bills of the Employees. Along with the pay bills, it also helps to prepare different kinds of bills such as DA Arrear, Bonus, Leave encashment Bills, etc.

Must Read:

What is PayManager PRI?

PayManager PRI is another feature of Pay Manager, which was developed for the Panchayati Raj Employees of Rajasthan Government. This helps in the preparation of Pay Bills for PanchayatiRaj Employees.

After reading the above few paragraphs, you’ve got an idea about Pay Manager & Pay Manager PRI.

I’ve also written a brief article about Shala Darpan where you can learn about ShalaDarpan Portal, Shala Darpan Login & its features.

Type of PayManager Login

There are four types of login options are available on PayManager Portal. Those are as follows:

- DDO Login: DDO Login is used for preparing Salary Bills, DA Arrears, Salary Arrear Bills, Leave Encashment Retirement Bills, FCV Bills, Surrender Bills, etc.

- Bank Login: Bank login is used by Treasury Officers and Banks for digitally signed e-Payment Files, Payment PDFs and to download them.

- Employee Login: Employee login enables government employees to log in and checks their monthly payslip & Income tax statement. There are some other facilities also provided by Employee Login.

- Department Login: Department Login is provided for Departments and third parties to check payment details related to their respective employees.

Now I am going to explain to you about DDO Login & How to work on DDO.

How to work on DDO?

If you want to prepare your school or Office bills, First go to official PayManager Website – Here

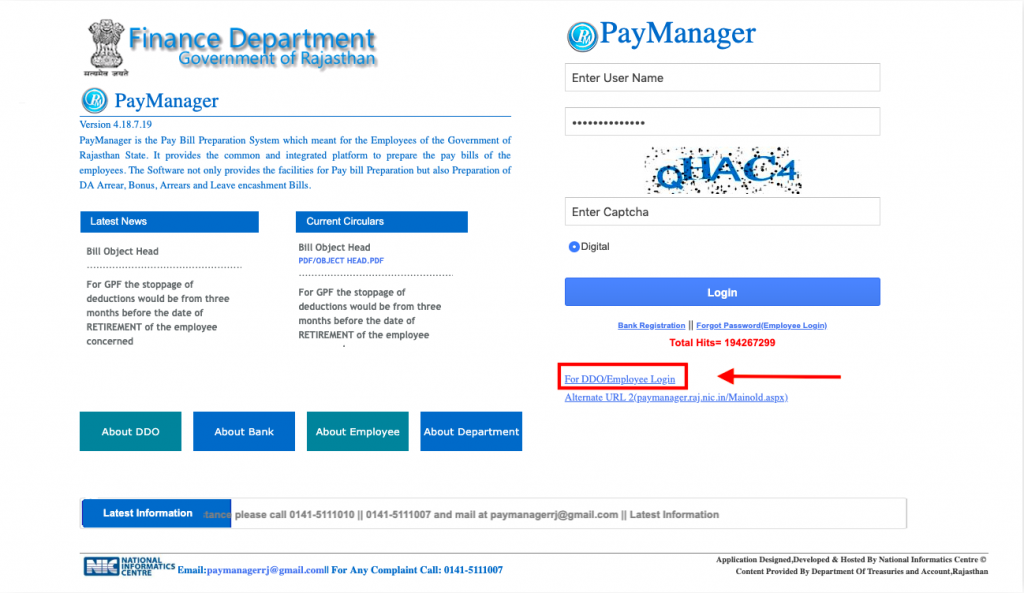

The home screen of the Pay Manager portal looks like the image below. Here on this page just click on the DDO Login link (as shown in the image below).

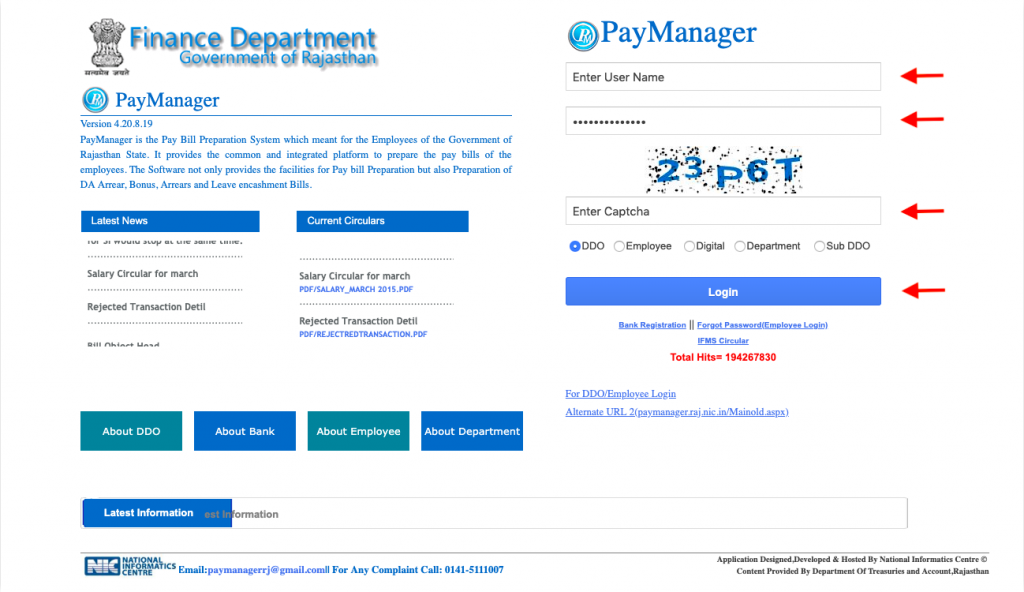

After clicking on the DDO Login link, You’ll be redirected to DDO Login Page, which looks like the image below.

Here on this page you just need to enter User Name in the first box & Password in the second box. After that, you need to fill the 5 Character Captcha as shown in the image and click on Login Button.

Note: Captcha is not Case Sensitive.

If you logging in, then the main dashboard will appear in front of you. (If, you are not redirecting to dashboard then Click on take me to main site button to reach to the main dashboard).

In the main DDO Dashboard, you will find the following options.

- Master

- Bill processing

- Authorization

- Reports

- Other Bills

- Employee Corner

- Systemadmin

- DDO Report treasury wise

- Help

- Log Out

How to Make Salary Bill at DDO Login

You’ve to follow the Six Steps to go through make a Salary bill at DDO login. These steps are as follows:

- Bill Allocation

- Employee pay Details in going to Salary Preparation

- Monthly Salary Process

- Go to the Report and check the Inner Bill

- Forward to DDO

- Bill forward to Treasury, Finally print the bill.

Bill Allocation

For allocating the bills you have to click on the Select Options button where you’ll find two options:

- 1st – Bill Allocation

- 2nd – Bill Modification

Now just click on Bill Allocation and click on allow Manuals in Bill Number Generate*

Here you’ve to write the Types of the bill you are Making in bill Type like Salary, TA, Medical, Office Expenses, FVC, etc.

Now, in bill Sub Type, you should select Regular, because most of the time regular Salary is Made.

After this, According to the bill Type, the Object to be Written. Which are as follows:

- 01 for Salary

- 03 for TA

- 04 For Medical

- o5 Filled for Office Expenses

Now, enter the Month for which Salary is to be made in Pay Month. Enter the Year in which the Salary is to be Made in the Pay Year. Today’s Date will come in Bill Date but you can also make backdated bills.

Now According to the bill Register put the Bill Number, bill Name and select the Account item under which the bill to be created.

Here click on Submit after filling all the above the mentioned information correctly.

Then you will receive the message saying that bill Register details added Successfully and OK will come in a dialogue Box.

Clicking on OK will complete the First Phase of your Bill Allocation.

you have been taught this task step by step in very Simple Language and at a Slow Pace, Because by telling the whole thing in a single day. It will become a slang, so a Person who learns Slowly Gets to learn at Least.

In this episode of Salary bill training, Bill will learn the work of Allocation. This is the first stage of making any bill. It is not possible to Make a bill Without giving the Bill Number. Bill No. Inscribed below bill processing to give the bill Number.

General Information

- Department Bills went Online from February 12.

- PD Head Personnel Bill went Online from November 16.

- Bill of SSA Personnel went Online From March 17.

Therefore, Demand GA- 55 Accordingly. If a PD Worker says to give me GA-55 Online from 2015, then you can say that Online GA-55 will be Available from November 16, Before Offline will be Made.

Go to Bill Processing and Go to Salary Preparation. After that, you go to Employee Pay Detail. Going to Salary Pay Detail, You Select *Month, Year and Select Group.

After Completing this Process, You will be able to see the names of all the members of the group on the Screen and will be Able to Edit their Salary.

Now Click on the Name Of the Personnel Whose Salary Allowance or Deduction you want to Amend. On Clicking On the Name, the Salary and Allowance of that Personnel will be Shown.

9 Types of Functions for Salary, Allowances and Deductions

- Add Allowance: In this, we will add Allowances of the Personnel Concerned.

- Add Deduction: In this, we have GPF, S.I. Loan and all other types of deductions.

- Add Nominee: In this, we will add the Account Number of the Nominee and pay it.

- Partial Payment: In this, We can make Partial Payment of Personnel.

- In this, We can remove the LIC of a person on Maturity and add a new LIC Policy.

- Dependent Deduction: It is deducted for the Dependent.

- Stop Payment: On clicking this Function, the reason for stopping the Salary is written and the Salary is Stopped.

- Loan Master: In this Loan Deduction is Done.

- Suspend: It is Used to make Salaries of Suspended Personnel.

If the Salary of any personnel is stopped and he has to be released again, then you go to release Pay and write the reason for making the bill, then the Salary will be Released. These allowances will show when you add Allowance.

There will be three types in it-

1st – Slab or, 2nd – Amount or, 3rd – Formula will fill the type according to allowance.

Similarly, add Deductions will show all Deductions.

Similarly, the type will have to be written in Deduction.

There will be three type in it:- 1st – Slab or, 2nd – Amount or, 3rd – Formula will fill the types According to the Deduction,

The formula is always used for NPS deductions. The amount has to be filled in income tax or Loan Deduction, while in RPMF, Slab is filled.

Similarly, in Allowance Formula is used for DA and HRA. If the Salary Allowances and Deductions of all personnel are required to be amended and the amendment has been done, then its second stage of making Salary here is Completed.

Monthly Bill Processing

You have to go to Salary Processing > Monthly SalaryProcess.

Clicking on the Monthly Salary Process will appear on your screen. You see will 2 boxes in it one is on Left and Other is on Right. Please note that if you have to make a bill for all the Personnel of that Group, click in the Right Box and Process it.

If you have to Create a bill for Partial Personnel of that Group, then click on both the right and left Boxes, but first Click on the left and then click on the right, then all the Name will be Shown.

After Selecting the month and year, the bill you are trying to process will become shown. Now click on the Personnel you want to bill and Process it. this message will be received as soon as it is Processed. The Massage of Salary Process Successfully will be soon on the Screen.

Important Information about Paymanager

If you have made the GPAS Proposal form online last Year and there is no Change this year, there is no need to be online every year. by your one-click information of GPF, SI balance and Outstanding loan will be received by you when you login SSO. For this, look at the Cursor on the right and click there. If your state Insurance is being deducted according to the salary Slab, then you do not need to fill the form of Further contract, it will Automatically join the further system.

Frequently Asked Questions

If the Employees of a group Receive the same Allowance equally, then by Selecting it, All the Employees of that group get the same Allowance.

If an Employee of a Group Deducts one of the Deductions Equally, then selecting the same will equally cut the entire group.

If there is more than one group on the PayManager and any Allowances are to be made equally, then you will use this Option.

If there is More than one group on the PayManager and any Deduction is to be done equally, then this Option is used.

This is a very Important Function. In this, What Allowance and Deductions an Employee has to do is insert/edit it here. Employee Pay shows Allowances and Deductions according to the Salary Option filled in the Personal and Pay & Bank Columns of the Detail Master.

If Someone is a deceased or Retried Employee (Before 12 February) and does not have master data on his PayManager, then you should Prepare his Master Data for Arrer Payment, for that the Employee ID of that Retired person Necessary is not.

This work will be done through DDO. The DDO will Write a Letter to the Concerned Treasury Officer for a Change in the Bank Account of his Personnel, in Which a Certificate of no dues in the Former Bank will be Given (No Dues). Along with a Legible copy of the New Account Passbook will have to be Attached.

For this, Send a verified Copy of the First Page of the Service Book of the Personnel Concerned by the DDO and Send it to the Treasury. There will be Amendments for Sure.

If you have to make a Partial Salary of a person, then you can do Bill Processing > Salary Preparation> Employee Pay. Go to Detail> Partial Pay and Make a Bill.

First of All, go to bill Processing and Select Employee Half Pay and Make a Bill Comfortably.

If You Complete all the columns of Employee Detail in master Option of Personnel, then there will be no problem in making the bill. If you keep it Complete then it will Become a Dilemma for you.

To Fill it, the Following Steps have to be Completed: 1st- Personal, 2- Status, 3- Pay & Bank, 4- Contact Details, 5- Employee Dates, 6 – Employee Number, 7- Family Details, 8- Scheme, 9- Image and 10- Crop Details.

First of all, go to add a billing role and submit a bonus by adding it and check the bonus by going to bill type. Now Bonus will come.

Except for the Day of Treasure forwarding of the bill, it is Mandatory to send the bill to the Treasury for the next two Working days otherwise the Authoring letter is issued by going to the Authorization, which will have to be signed with the bill by signing the DDO.

To make a bill of Uniforms, you have to go to FVC in bill type and then submit the liveries in bill sub Type.

Select the month in which you have made the bill, that is, you select September- 18.

No data found is telling that employees’ salary is stopped. You First Release his Salary, then go to Transfer Employee and Transfer. One thing to keep in mind is that after searching after entering the DDO code, Check the name of the next office or school and transfer after complete Satisfaction.

Yes, it can be removed at all. First, you go to Reports and then to DDO Reports. After that go to Employee Related Reports and then go to GA-55 and print GA-55 together with the entire group Personnel.

By going to Reports> DDO Reports> DDO Related Reports > Employee Transfer Details, you get Information about Year- wise Transferred Employee.

By going to Reports> DDO Reports> DDO Related Reports >TV Number Report, you will get information about all types of bill by Month. For this, You have to Click on all type Bills.

| Read Latest Updates On |

| Sarkari Result || Sarkari Exam || Sarkari Jobs || Free Job Alert || Sarkari Results || Eaadhar || Eaadhar Download || Aadhar Card Download || |